Maximize Your Financial Prospective with Professional Debt Management Plan Services

Maximize Your Financial Prospective with Professional Debt Management Plan Services

Blog Article

Comprehending the Significance of a Well-Structured Debt Monitoring Prepare For Financial Security

As individuals navigate the intricacies of handling their economic commitments, a strategic approach to financial debt monitoring can lead the method for a much more prosperous and safe and secure future. By recognizing the essential concepts and useful strategies behind efficient financial obligation administration, individuals can unlock the path to not just decreasing financial obligation problems however also growing a solid foundation for lasting monetary health.

The Impact of Debt on Financial Security

In addition, the influence of financial debt on economic stability expands past simply the economic facets. It can additionally influence psychological health and wellness, connections, and general wellness. The tension and stress and anxiety linked with overwhelming financial debt can hinder decision-making abilities and strain specialist and personal relationships.

For that reason, it is critical for companies and individuals to very carefully handle their financial obligation degrees, making sure that it lines up with their monetary goals and capabilities. By comprehending the ramifications of financial obligation on monetary security and executing efficient financial debt monitoring methods, organizations and people can protect a more thriving and steady financial future.

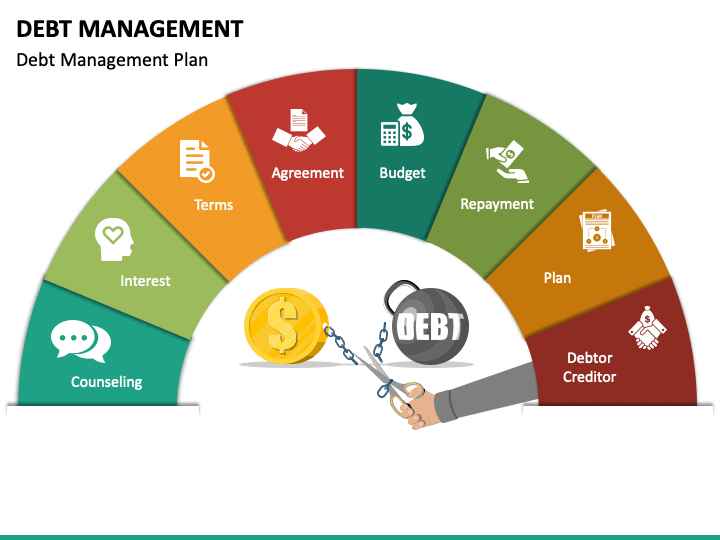

Elements of an Efficient Debt Administration Plan

Offered the important value of maintaining monetary stability among varying financial debt levels, recognizing the necessary elements of an effective financial debt administration plan is critical for individuals and organizations alike. A thorough financial obligation monitoring strategy commonly consists of a thorough assessment of current financial obligations, earnings, and expenses to develop a clear economic picture. Establishing attainable and details monetary objectives is crucial in leading the financial obligation repayment procedure. Prioritizing financial obligations based upon rate of interest, with a concentrate on paying off high-interest financial obligations initially, can conserve money over time. Producing a detailed budget that assigns funds for financial obligation payment while still covering necessary expenditures is essential. Discussing with lenders for reduced rates of interest or modified repayment plans can also become part of an effective debt management strategy. Additionally, developing an emergency situation fund to avoid building up more debt in instance of unanticipated expenditures is a sensible element of a well-shaped financial obligation monitoring strategy. On a regular basis readjusting the strategy and keeping track of as required guarantees its efficiency in accomplishing financial stability.

Advantages of Applying a Financial Debt Settlement Strategy

Tips for Producing a Lasting Spending Plan

Structure a solid economic foundation starts with grasping the art of creating a sustainable budget that lines up with your lasting economic objectives and complements your debt payment method. To develop a budget that advertises economic security, beginning by tracking your income and costs to recognize your monetary patterns. Classify your expenditures into essential (such as real estate, energies, and groceries) and non-essential (like eating in restaurants and home entertainment) to prioritize where your money goes. Set practical spending limitations for each category, making certain that your crucial expenses have a peek at these guys are covered while leaving space for financial savings and debt repayments.

Keep in mind to allot a part of your spending plan towards developing an emergency situation fund to cover unexpected monetary obstacles. By following these ideas and remaining disciplined in your budgeting approach, you can produce a lasting economic strategy that supports your long-lasting objectives and aids you achieve enduring economic stability.

Tracking and Readjusting Your Financial Obligation Administration Plan

Routinely assessing and adjusting your financial obligation monitoring strategy is vital for keeping economic progress and achieving debt payment goals. Checking your financial debt management plan includes monitoring your income, costs, and financial debt balances to guarantee that you are staying on track with your economic purposes (debt management plan services). By on a regular basis evaluating your strategy, you can identify any type of locations that might require adjustment, such as cutting down on unneeded costs or boosting your financial obligation payments

Adjusting your debt monitoring strategy may be required as your financial situation evolves. Life changes, such as a task loss or unanticipated expenditures, may require you to reassess your strategy and make adjustments to accommodate these brand-new scenarios. Furthermore, as you pay down your financial debt, you may find that you have added funds readily available to web assign towards financial debt payment or savings.

Conclusion

Finally, a well-structured debt management strategy is vital for maintaining economic stability. By recognizing the effect of debt, implementing a settlement technique, developing a sustainable spending plan, and monitoring and changing the strategy as needed, people can take control of their financial circumstance and work towards a debt-free future. It is critical to prioritize economic health and make educated decisions to protect a prosperous and steady monetary future.

By understanding the essential concepts and sensible approaches behind effective financial obligation management, people can unlock the path to not only decreasing debt concerns but also growing a strong structure for long-term financial wellness.

Provided the critical significance of preserving financial security among differing debt levels, understanding the vital elements of a reliable financial debt monitoring strategy is extremely important for organizations and individuals alike. An extensive financial obligation management plan normally consists of an extensive analysis of current financial obligations, earnings, and expenses to establish a clear economic picture - debt management plan services.Routinely examining and adapting your financial obligation management plan is vital for maintaining monetary progression and attaining debt repayment objectives. Checking your financial debt administration plan involves maintaining track of your income, costs, and debt equilibriums to ensure that you are staying on track with your financial objectives

Report this page